We’re ready to help you

Schedule an Introductory Call to learn more about our services.

Take Control of Your Financial World

Learn how the Hall & Burns Wealth Management System makes it easy to manage both your wealth and your well-being.

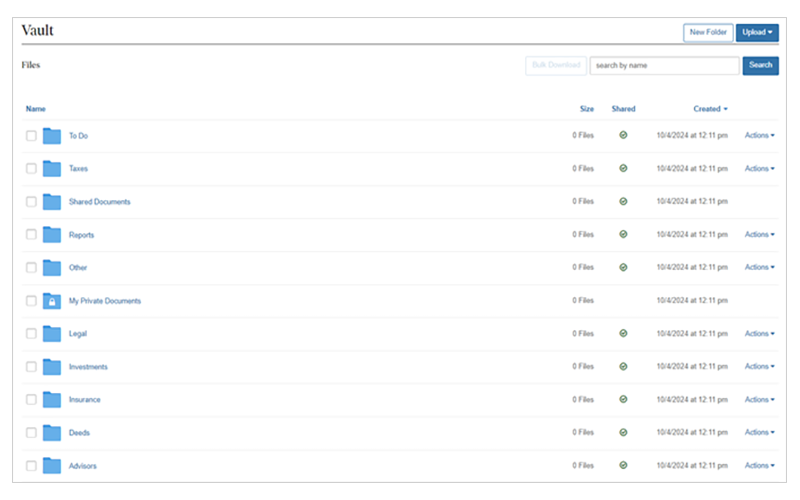

Your Personal Financial Website

Click the tabs below to explore features of the Hall & Burns Client Portal.

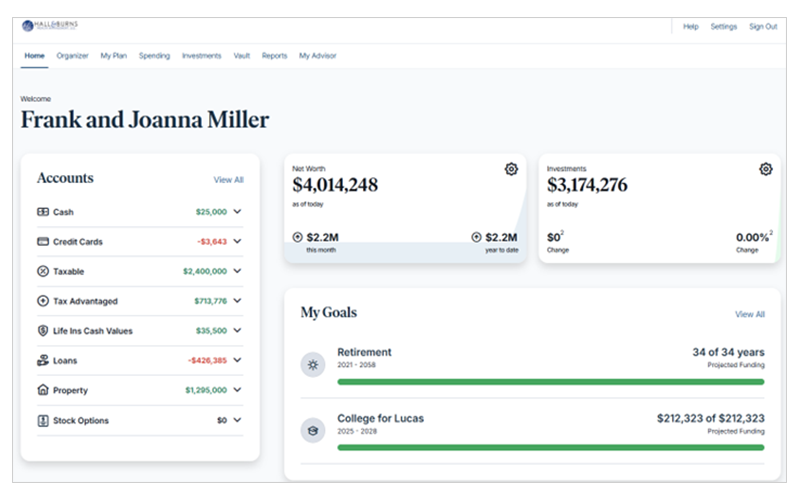

Dashboard

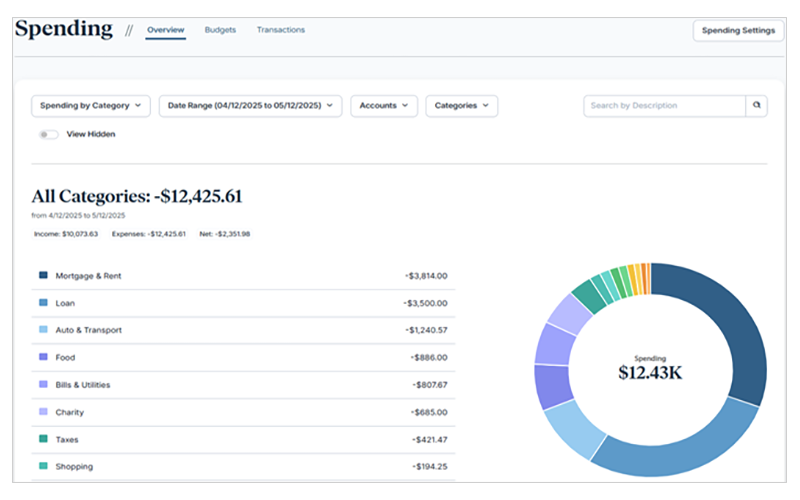

Stay on top of your finances with our user-friendly dashboard, offering a clear and organized view of all your accounts on one convenient page.

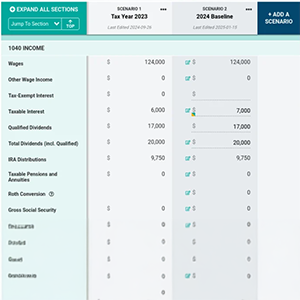

Wondering If You're Paying Too Much in Taxes?

Let us take a look — risk-free. Upload your tax return and we'll provide a free, personalized analysis that shows where you may be missing deductions, credits, or other planning opportunities. We synthesize your tax documents to map where and how your money could flourish with Roth conversions, tax-efficient withdrawals, charitable giving, and much more.

UPLOAD A COPY OF YOUR TAX RETURN

RECEIVE INITIAL TAX ANALYSIS REPORT

MEET TO DISCUSS

STRATEGIES

MODEL TAX SCENARIOS AND IMPLEMENT

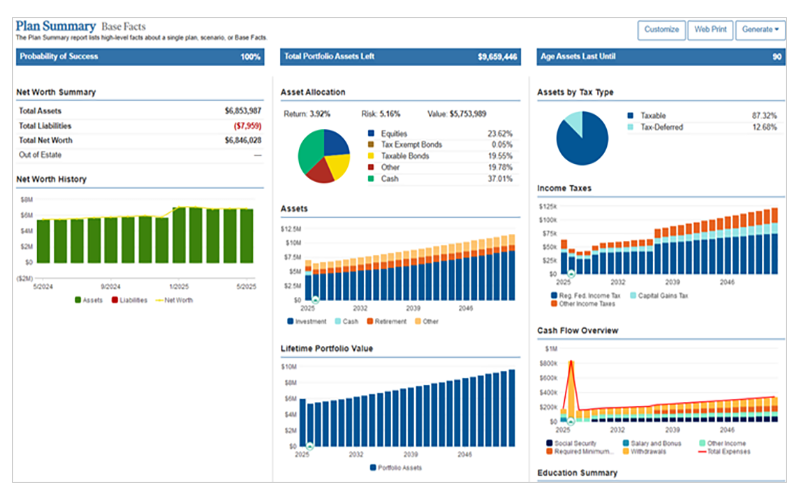

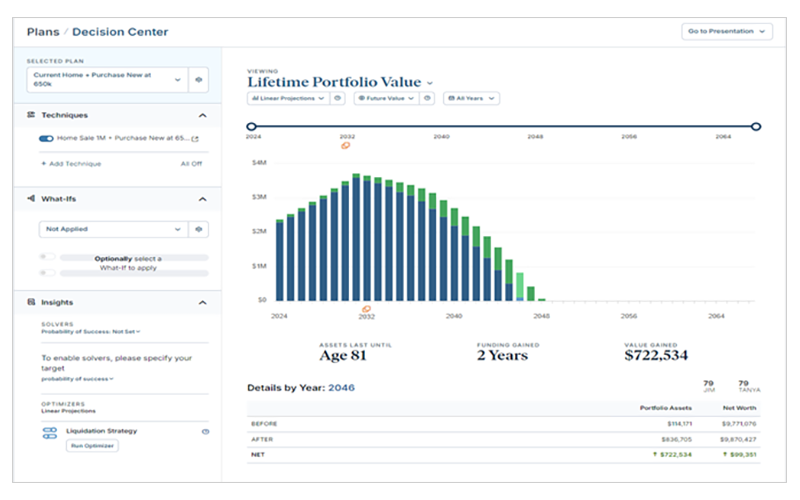

FINANCIAL PLANNING VISUALIZED

Download four of our most popular guides and checklists:

- What Accounts Should I Consider If I Want to Save More?

- What Documents Do I Need To Keep On File?

- What Issues Should I Consider Before I Retire?

- What Issues Should I Consider Before The End Of The Year?

See how we use flowcharts and checklists to systematize our processes and help our clients

navigate complex topics and strategies. Download your copy today.